September 2023

Increased regulation

In recent years, there has been a growing trend towards increased regulation of ESG reporting such as in the EU, ERFS, CRSD and ISSB, this is being driven by a number of factors, including the increasing importance of ESG factors to investors, the need to mitigate climate risk, and the desire to improve corporate transparency. In the United States, for example, the Securities and Exchange Commission (SEC) has proposed new rules that would require public companies to disclose more information about their ESG performance. This direction will mean a merging of the regulatory and the voluntary, this and ESG will form part of an overarching framework for mandatory reporting.

Greater standardisation

There is currently a lack of standardisation in ESG reporting, which makes it difficult for investors to compare companies and assess their ESG performance. This is likely to change in the future, as there is a growing consensus on the need for common ESG metrics and frameworks. The Taskforce on Climate-related Financial Disclosures (TCFD) has developed a widely-adopted framework for climate-related disclosures, and other frameworks are also being developed. Under UNRISD proposals reporting will be uniform and align with the new ISSB standards.

More focus on double materiality

In the past, ESG reporting has often focused on a broad range of issues. However, in the future, there is likely to be a greater focus on materiality, meaning that companies will only need to report on the ESG issues that are most important to their business and their stakeholders. This will help to ensure that ESG reporting is more relevant and useful to investors and other stakeholders.

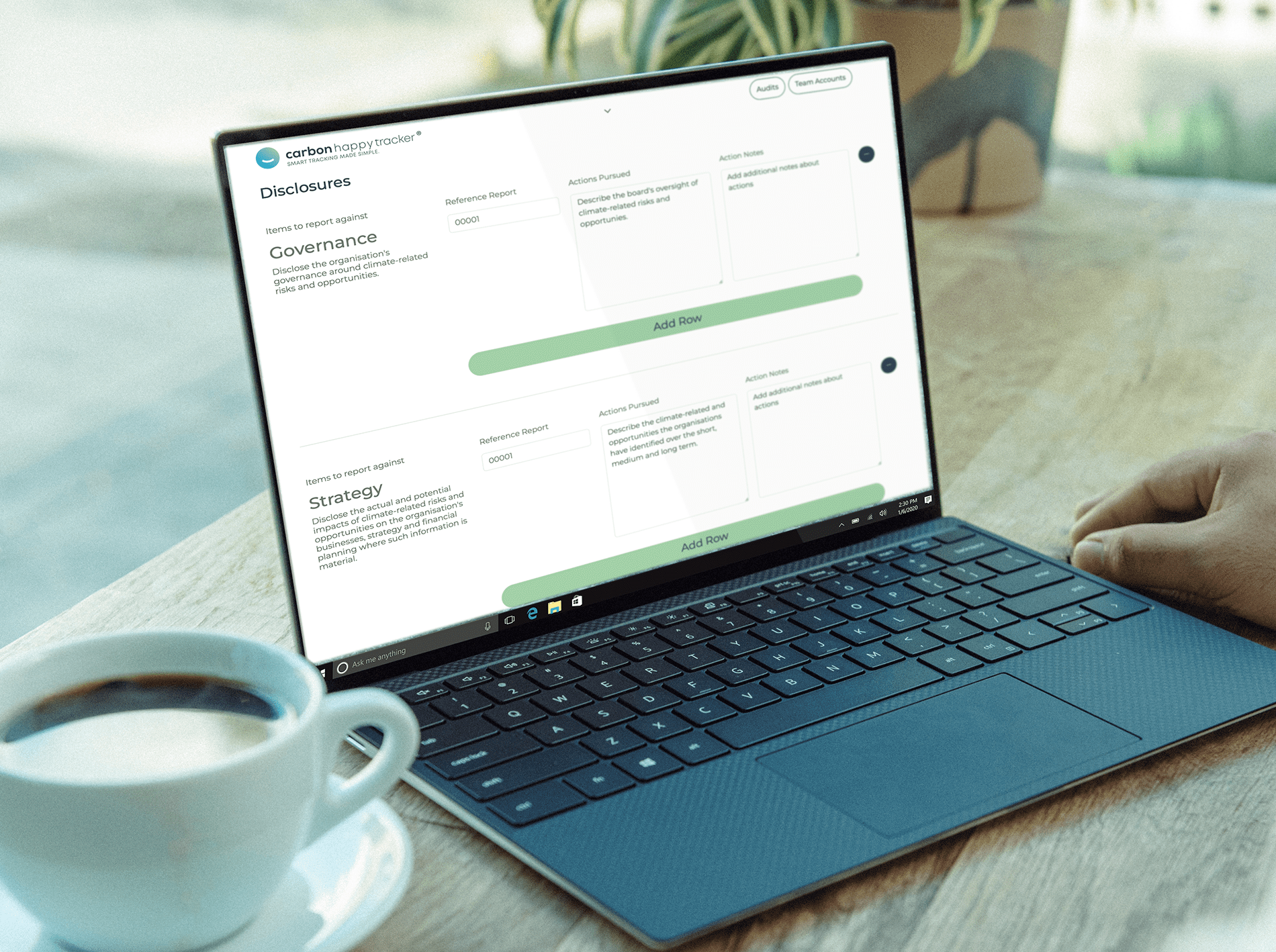

More use of technology

Technology is already being used to improve ESG reporting, and this trend is likely to continue in the future. For example, artificial intelligence can be used to automate the collection and analysis of ESG data, and blockchain can be used to create a more secure and transparent way to store and share ESG data.

ESG reporting is not just about providing information to investors. It is also about engaging with stakeholders, such as employees, customers, and suppliers, on ESG issues. In the future, there is likely to be a greater focus on stakeholder engagement, as companies seek to build trust and credibility with their stakeholders.

More From The Blog

- World Clean Data Day 2024

- DTM Legal Partners with Carbon Happy World to Strengthen ESG Commitment in Liverpool City Region

- Embracing Sustainability: Your Pathway to Procurement Success

- What does the future of ESG Reporting look like?

- Carbon Happy World tell you what double materiality and ESG reporting is.